Updated October 5, 2023

We have been informed by multiple customers of a phone and texting scam.

Texting Scam

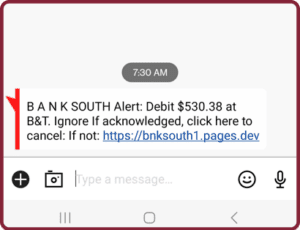

Multiple customers have reported receiving text messages regarding their BankSouth account for a specific transaction. The text contains a link to what appears to be the BankSouth website but is fraudulent. If you receive a text that appears to be from BankSouth, please DO NOT take action or go to any links.

If you receive this text and went to any links, please contact our Customer Care team immediately at 706.453.2265. Here is an example of one of the spam text messages.

Phone Scam

Customers have reported being contacted from a mirrored number that displays as BankSouth on the caller ID. The caller is requesting immediate money for transfer or their credentials to log in to their online banking account. Please continue reading.

Please note that BankSouth will NEVER call and request access to online banking and/or immediate transfers from its customers.

How to Avoid and Report Scams

What BankSouth WILL ask for over the phone to verify your identity:

- Last four digits of your SSN (never the full number).

- Your address.

- Your birthday.

What BankSouth WON’T ask for over the phone or text:

- Your Personal Identification Number (PIN).

- The CVV (Card Verification Value) on the back of your debit card.

- Your online banking login credentials.

- Your security code for online banking.

What to do if you fall for a bank scam:

- Contact BankSouth immediately at 706.453.2265.

- Secure your email and other communication accounts by changing your password and setting up two-factor authentication.

- Monitor credit reports and consider placing a fraud alert on them.

- Consider contacting the Federal Trade Commission to report an ID theft incident, and filing a report with local law enforcement.

Here are some tips to avoid scams:

- Don’t give money, personal information, or account numbers to people or companies you don’t know or trust.

- Resist the pressure to act immediately.

- Ask questions.

- Hang up on any bank impersonator calls and call back using a trusted phone number on our website at banksouth.com/help.

- Avoid clicking on any links in text messages claiming to be BankSouth (we will never text you with a link).

- Avoid the call or text and contact the “sender” through a confirmed phone number or a trusted website.

For more information and recently reported scams, read this article from us or visit banksneveraskthat.com.